How To Find Bearish Stocks

A Comprehensive Guide to Triangle Patterns

Triangle patterns are a chart pattern commonly identified by traders when a stock cost's trading range narrows following an uptrend or downtrend. Unlike other chart patterns, which signal a clear directionality to the forthcoming cost movement, triangle patterns tin anticipate either a continuation of the previous trend or a reversal. Although triangles more oftentimes predict a continuation of the previous trend, it is essential for traders to watch for a breakout of the triangle before acting on this chart pattern.

Triangle Patterns

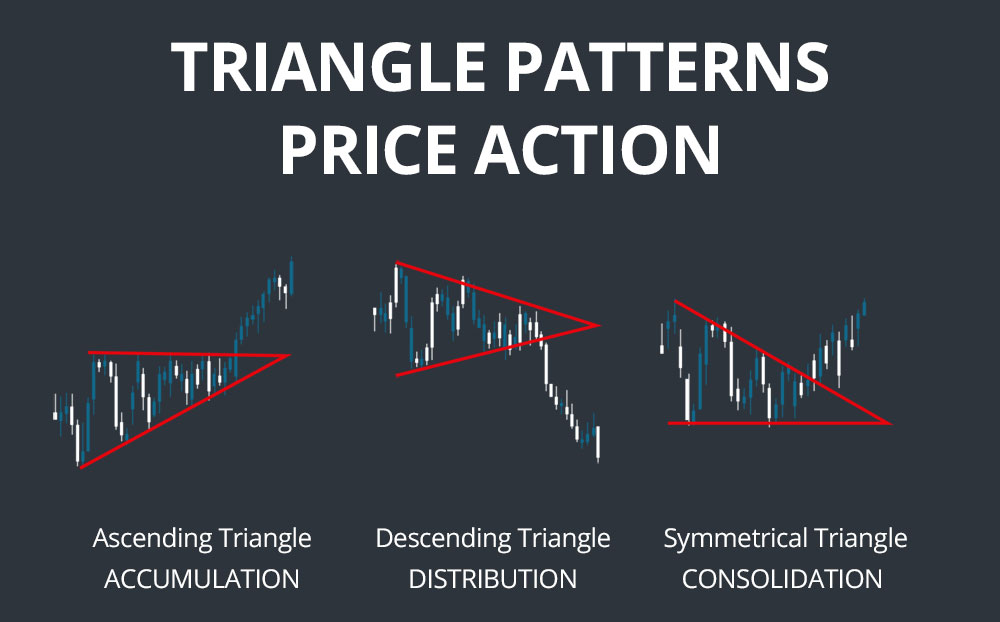

A triangle pattern forms when a stock's trading range narrows post-obit an uptrend or downtrend, normally indicating a consolidation, accumulation, or distribution before a continuation or reversal.

Triangle patterns come in three varieties – ascending, descending, and symmetrical – although all three types of triangles are interpreted similarly.

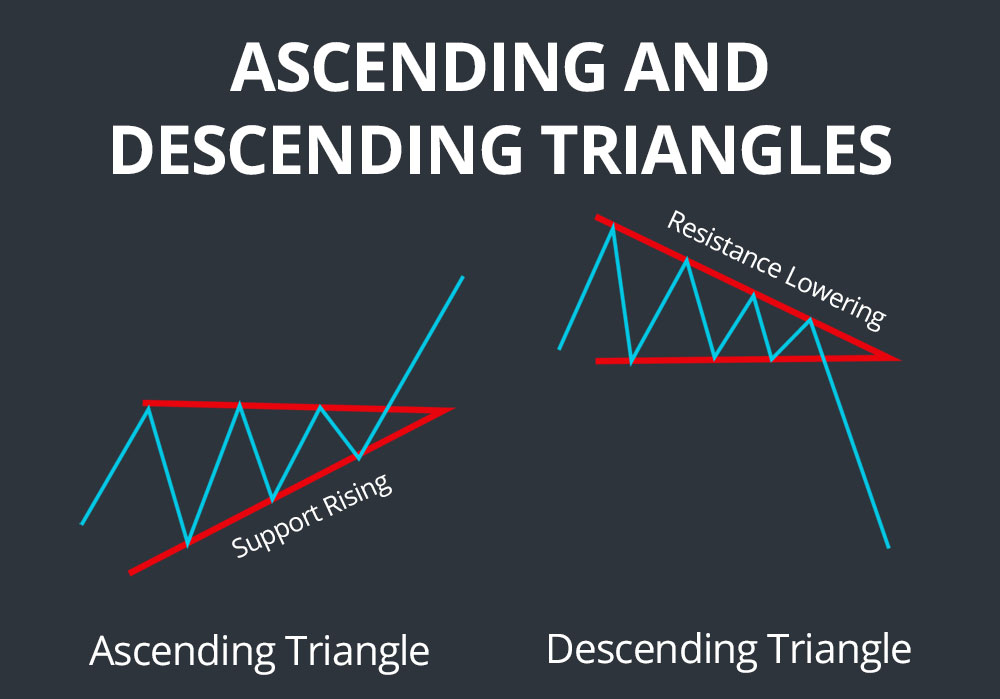

Ascending and Descending Triangles

Ascending and descending triangle patterns are correct-angle triangles in that the line extending along two or more lows or two or more than highs, respectively, is horizontal. Ascending triangles accept a rise lower trendline as a result of aggregating and are always considered bullish signals regardless of whether they form after an uptrend or downtrend. Descending triangles have a falling upper trendline equally a result of distribution and are always considered bearish signals.

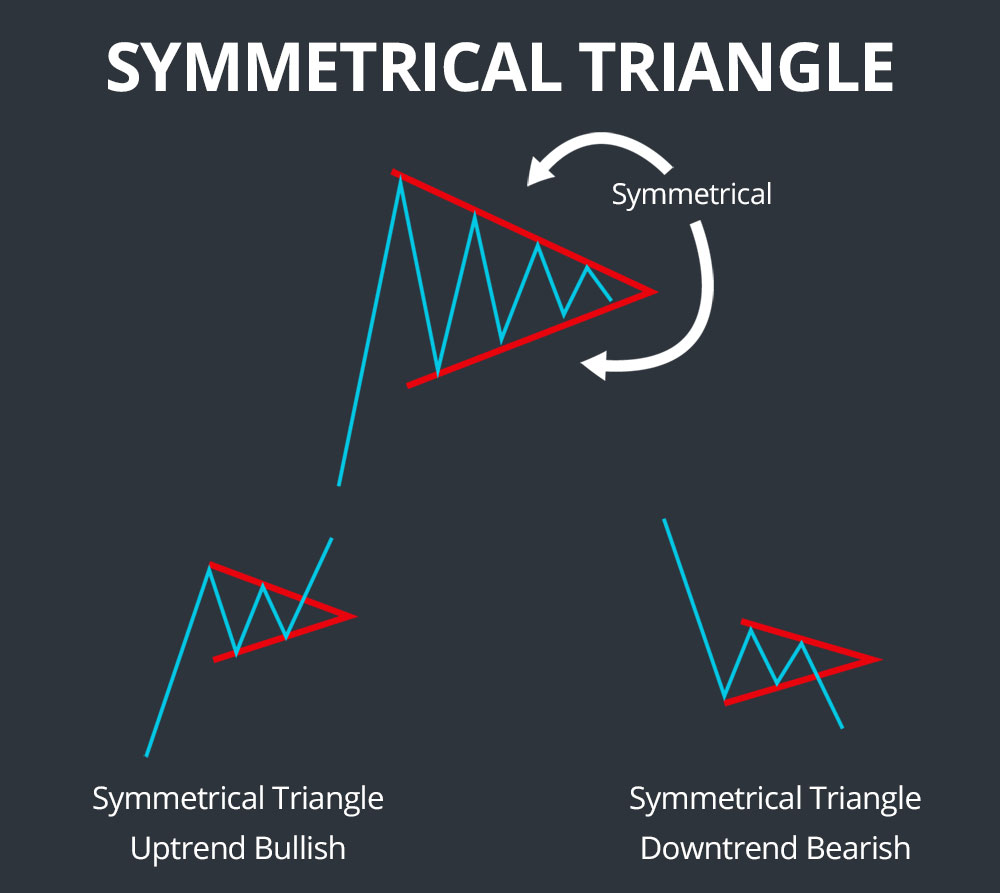

Symmetrical Triangles

Symmetrical triangles have descending highs and ascending lows such that both the upper and lower trendlines are angled towards the triangle's apex. Symmetrical triangles are a sign of consolidation and unremarkably result in a continuation of the prior trend, although they can likewise signal reversals.

Triangle Pattern Timescales

Triangle patterns are most commonly applied on daily charts and interpreted over a period of several months. For example, strong triangle patterns on daily chart require a prior trend that is at least a few months quondam and typically develop for several months before a breakout occurs. Still, triangle patterns can besides be observed and used for trading on shorter timescales, although doing and then leaves the drawing of the triangle patterns up to a greater degree of interpretation.

Triangle Patterns Simplified

Triangle patterns piece of work considering they stand for underlying patterns of consolidation (symmetrical triangles), accumulation (ascending triangles), or distribution (descending triangles). In symmetrical triangles, both bullish and surly traders are evening out and testing the price of a stock following a pregnant price trend until somewhen either bulls or bears win out – with the result usually post-obit the lead of the previous trend. In an ascending triangle, buyers continue to go more ambitious over time – resulting in a rising lower trendline as subsequent lows increase – until they eventually win out over bearish traders and the stock price breaks out. The contrary activity occurs in a descending triangle, where sellers are becoming more than ambitious and driving consecutive highs lower until the stock breaks out bearishly.

How to Trade Triangle Patterns

A symmetrical triangle requires at to the lowest degree iv points – two highs, where the second high is lower than the outset, and two lows, where the 2d depression is higher than the outset. In ascending triangles the highs are the same across the triangle rather than descending, while in descending triangles the lows are the same beyond the triangle rather than ascending.

For a triangle to be, in that location must be a well-established prior trend: for case, one that is at to the lowest degree a few months quondam when looking at a daily chart.

For all three types of triangle patterns, drawing a line from the first high to the second and continuing it while drawing a line from the beginning low to the second and continuing should form a triangle as the two lines intersect. The triangle pattern identification is more than supported as more than high and low points are added to the lines. As the stock proceeds further into the triangle pattern over time, volume should also diminish.

Triangle patterns typically last for anywhere from one months to three months or more on a daily chart earlier a breakout occurs, when the stock price moves exterior the lines of the triangle. The best price action occurs when the breakout forms about halfway to three-quarters of the style to the apex of the triangle, where the triangle's length is measured from the apex to the base of operations of the lower trendline. A intermission earlier or after this indicate may be insignificant as the stock has non fully consolidated or the breakout becomes inevitable equally the apex approaches.

The direction and strength of the breakout is extremely important. Although the direction of the initial break should indicate whether the previous trend will keep or reverse in a symmetrical triangle, it is important for traders to ostend the breakout before trading since triangles resulting in reversals frequently feature imitation breakouts. Stiff breakouts will come up with a spike in trading volume, specially for uptrends, and will motility at least several pct of the price also as last for several days.

Later the breakout, the apex and breakout cost levels typically act every bit back up or resistance levels. To estimate a price target on the breakout, measure out the base of the triangle – the altitude between the widest high and low points on the triangle – and add together that to the price at the breakout bespeak. Alternatively, draw a trendline parallel to the lower triangle line that extends from the highest high in the triangle.

Examples

The kickoff instance shows a symmetrical triangle post-obit an extended uptrend. The lower trendline has two support points, while the upper trendline has three. The breakout occurs in the management of the prior tendency and is strong enough to provide confidence in the continuation. A secondary breakout can be seen equally the stock price breaks above the price target predicted past the triangle design.

The 2d example shows a ascending triangle design, with iii consecutive highs at a abiding level and iii sequent lows increasing each time. The breakout occurs bullishly and the extent of the following uptrend is predicted nearly exactly by the height of the base of the ascending triangle.

Conclusion

Triangle patterns are oftentimes observed post-obit a strong, extended price trend equally buyers and sellers test the new price of a stock and become more than or less ambitious over time. Ascending triangles are always considered bullish signals and descending triangles are always considered bearish signals, while symmetrical triangles typically consequence in a continuation of the prior trend only may too signal a reversal. Triangles are highly favorable trading patterns because they are straightforward to interpret and confirm and plant support and resistance levels and a cost target post-obit a breakout.

Source: https://scanz.com/triangle-chart-patterns/

Posted by: mckinneychithin.blogspot.com

0 Response to "How To Find Bearish Stocks"

Post a Comment